I recently gave a talk to a group of UK IT directors about ‘what’s hot – and not – in 2021.’ Here is that talk and the slides. As always there are a number of other things I could have included, and I’d be interested to use this as a discussion starter – what would you include?

After the weirdest year ever in 2020 I think most of us looked forward to some normality in 2021 but it didn’t take long for us to realise that we were all deluded.

People are still talking about how incredible the transition was from being almost entirely office based and in many cases, paper based to virtual working. But we’re entering a new chapter where the pressure is on to not only to work from home but to be able to work from anywhere and not just to make do but to make working practices as efficient as possible. I’ll come on to talk a bit more about that in a little while.

Before I get into the weeds of this talk I wanted to make an observation, which is that the emphasis on technology now is all pervasive, and that brings opportunities and challenges.

In a Wolters Kluwer Future Ready Lawyer Survey Report for 2021, which I like because it polls over 700 legal professionals across the US and Europe, the two top trends cited as having the biggest impact on organizations over the next three years are: Increasing Importance of Legal Technology (77%); and Coping with Increased Volume and Complexity of Information (77%). 63% of law firms said they will increase their technology investment, up from 60% in 2020.

Just as a slightly funny and quite telling aside from that survey, 69% of law firms said they expect Big Data and Predictive Analytics to have an impact on their organizations over the next three years. But just 22% say they understood what big data and predictive analytics really are, so make of that what you will.

In that same survey the importance that clients placed on law firms’ use of technology also surged. 82% of corporate legal departments say it’s important the law firms they work with fully leverage technology, although again I query what that really means.

One thing that we can definitely say is that the pandemic has further elevated the status of technology beyond law firm techies wildest dreams, but firms continue to have many challenges around the delivery of that and lawyers remain in many cases averse to working in new ways, despite all the rhetoric. Now really is the time to encourage legal professionals to be competent in tech not just in talking about it.

What’s Hot?

In terms of what is hot in 2021, the very first thing that comes to my mind is Microsoft and at the end of my session I’d love to come back to this topic that I’m going to spend quite a bit of time talking about.

Law firms have over the past year doubled down on their investment in Microsoft. Obviously law firms have always been heavily Microsoft based but we’ve seen more firms moving to Microsoft 365 and Exchange Online. Conversations about the cloud are very different now, although I think we’re at risk of making out that the move to the cloud is far simpler than it really is for many firms. Speaking to some CIOs, they are nervous about adopting cloud systems in terms of how they will interact and impact the spaghetti junction of other systems.

It does seem largely as though the question for most firms if no longer if they will utilize Microsoft 365, but how much of it will they utilize? I spoke with Matt Peers, who is COO of Linklaters the other week and he said that the firm is likely to end up with everything in Microsoft 365 within a little while, which is a change for Linklaters, but interestingly from an email standpoint the firm simply doesn’t have capacity at the moment, and capacity does seem to be an issue for many of you.

The legal sector is very much back in Microsoft’s sights again and this year they launched Microsoft 365 Solution for Legal, which is designed to help firms protect client matter data and address their concerns over blind subpoenas, which was one of the barriers for Linklaters.

Microsoft this year unveiled a four-step programme to rolling out Teams and leveraging 365 security and compliance tools and I can send anyone who is interested links to that. Microsoft is also working with document management vendors to create better integrations and acknowledges that a lot of people don’t currently want to use SharePoint.

Corporates have been quick to adopt 365 and law firms need to have a coherent 365 strategy including an awareness of its in built data analytics capability.

Teams – Internal Collaboration

Teams has been one of the hottest bits of tech this year. As you know, it is designed to be the place where people live, where content can be delivered, and that you can access regardless of what device you are using. It also answers the question that legal organisations have been asking for years – what comes after email, particularly for internal communication.

Most law firms I’ve spoken to deployed Teams to a certain extent as the pandemic hit. They included Allen & Overy; Fieldfisher; Cripps Pemberton Greenish; and Browne Jacobson, where Abbie Ewen began transitioning away from Skype at the end of 2020 in favour of Teams.

Interestingly at Browne Jacobson, which at the beginning of lockdown finished a Windows 10 and Office 365 rollout, including bringing Exchange online, they immediately introduced a strict process for approving Teams. But at most firms it is still only being used for a fraction of its full functionality – often for telephony and chat – and IT teams are nervous about Teams turning into the Wild West with data all over the place.

We did a great webinar with Prosperoware looking at how to set Teams up and I can send you a link if you’re interested. Repstor and Epona are also doing some very cool things around provisioning and as you know Repstor is now part of Intapp as of this year.

Teams – External Collaboration

In terms of external collaboration, there is client pressure for more firms to start using it and widespread agreement that it makes sense to use the same system as your client.

There are obvious concerns around information governance but there are solutions and lots of guidance out there.

Teams – Project Management – Osborne Clarke

You can use Teams as a project management tool and before I move off the Microsoft topic – and I swear I’m not on commission – I just wanted to share with you or at least remind you of some of the cool stuff that firms like Osborne Clarke is doing with Teams because they are one of the firms really leading the way.

OC has built its collaboration platform 1.0 around HighQ but it has been running a proof of concept using Teams as the basis for Collaboration 2.0. I think IT director Nathan Hayes summed up a lot of people’s current thought process when he told me: “We are going through an evaluation process: do we move to an enterprise stack or continue with legal technology to build the platform at its core.”

OC is rolling out Microsoft 365 and has formed a multi-disciplinary consulting group of lawyers, trainers and techies to help professionals develop matter plans using teams.

One of the partners has codified an entire matter in Teams Planner and what’s interesting is that partners are aware of Teams because Microsoft is doing a great job of promoting it, which in many ways makes your life a lot easier.

It will be interesting to see what this means long term for HighQ. I’m also wondering what is happening with Lupl and need to catch up with them – after a big bang entry and a $14m funding round in January I do wonder how Lupl will compete with Teams.

Microsoft – All Your Eggs In One Basket?

The one thing that people are thinking about is the risk profile from having all your eggs in one Microsoft basket, and that came to roost recently when Microsoft bumped up their prices by 20%, which is huge. I’d be interested to hear your take on that at the end.

Platformisation And The Rise Of The Marketplace

My other observations as to the top trends over the past year don’t necessarily come in any particular order, but I want to talk about platformisation next, and the drive among vendors and consultants to provide everything you need under one roof.

Platformisation

Some of the biggest complaints I heard when I first entered the legal tech industry were around the sheer number of vendors and point solutions in the legal sector and what a nightmare that creates, and so consolidation is in many ways a really good thing, even though it’s got to the stage where when Litera calls me I’m wondering which one of our advertisers they have nobbled up now.

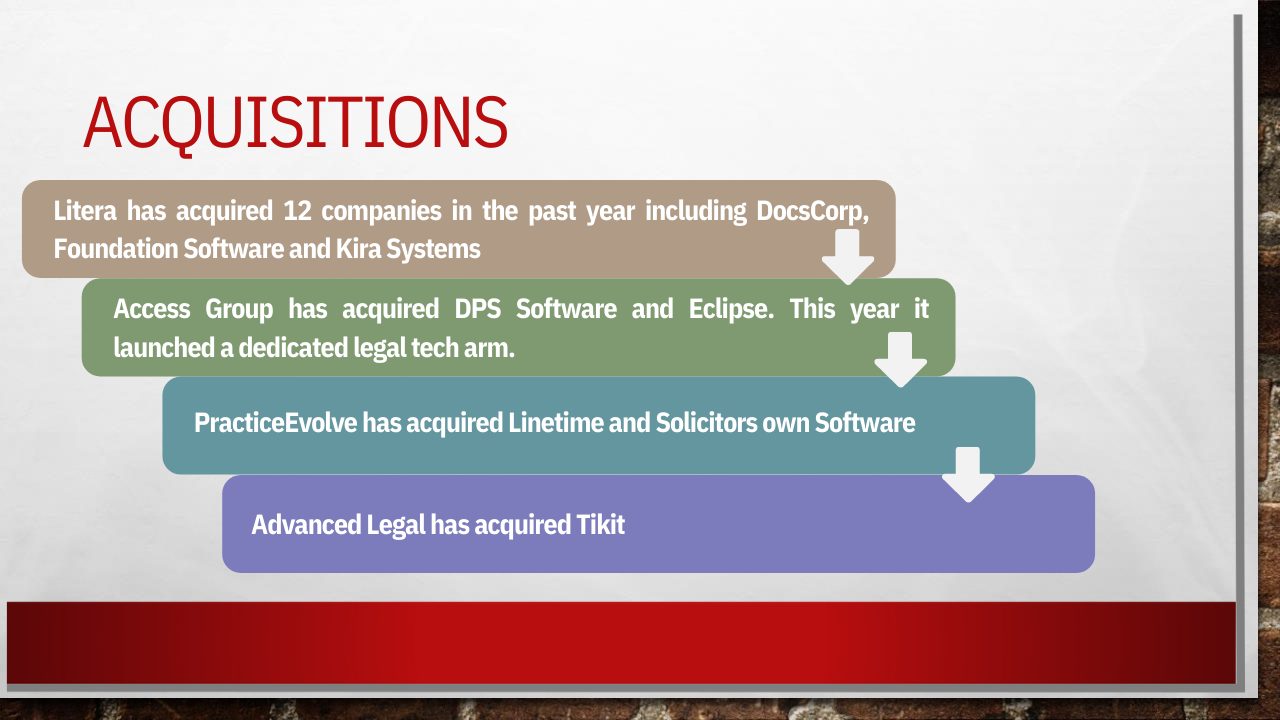

Litera is leading the platformisation charge and over the past year it has acquired 12 companies including DocsCorp and Kira Systems. With DocsCorp I nearly fell off my chair.

Litera started out wanting to own the document drafting space but their ambition has moved out from the practice of law to the business of law and they are promising to do the hard work of integrating all these different systems for you.

Venture capital group Hg is very much behind much of this consolidation drive. Hg also part owns the Access Group, which in July last year acquired DPS Software and before that Eclipse, and I’m going to come on to talk about private equity in a second. The Access Workspace is bringing together all its products and services horizontally. It has 100 different software products and aims to allow law firms to eventually manage every aspect of their operations through the workspace without having to worry about integration. It is also focussing on running analytics across the entire platform, with all the huge amounts of data it has. This year Access launched a dedicated legal tech arm.

Another company quietly growing is one-stop-shop practice management provider PracticeEvolve, which has acquired both Linetime and more recently, in December last year, Solicitors Own Software. It started out life as Documatics in Ireland but after a merger with Australian company ClickOne has been trading as PracticeEvolve in Australia for eight and it is making a big play for the UK market.

And then there is case management provider Advanced Legal, which last year acquired Tikit from BT in a rather bizarre sale where Tikit appeared to not know that it was being acquired. Advanced has been slightly quiet since acquiring Tikit but before that it acquired Oyez Professional Services. It is the third largest British software and services vendors, with £254m annual turnover, so it will be interesting to see what comes out of Advanced Legal next.

The Rise Of The Marketplace

One of the really interesting very recent trends I’ve been following is the rise of the legal marketplace, which aim to simplify the procurement and in some cases implementation of technology.

First up I want to flag the recent progress made by Reynen Court, and you’ll be aware that Reynen Court vets vendors and in some cases enables law firms to download their software straight from the site in the way you can from an app store.

Lots of people have questions around Reynen Court and do think they are lacking in public customer success stories, but what they are trying to do is to take away from you the pain of having to vet and test a ton of different companies and I’d be interested to come back and see if any of you have experience of using the platform.

Reynen Court this August created a new consortium of 20 corporates including Morgan Stanley, Cisco and Intel. Their backing is huge and according to Morgan Stanley’s managing director and global head of technology, Max Iori, they are driven by the opportunity to reduce the time and cost it takes legal teams to source and deploy new cloud-based solutions. Bringing the client into the dialogue is very powerful and I’m excited to see where this goes.

Reynen Court have got the most developed platform but lots of other vendors and consultants are now launching marketplaces – and they do differ from the partner programmes that have long been run by the likes of iManage because they go as far as recommending a particular technology and incorporating an RFP process into their own marketplace.

I don’t want to spend too long on this and can provide you with more details after if you’re interested but the marketplace I wanted to flag is a US entity called LexFusion that launched this year. It’s aiming the change the way that law firms and in-house legal teams purchase technology. It vets and selects best of breed technology across all relevant categories and in effect says that is the tech you should be using. It is creating a kind of network or collective between those vendors to encourage discussions around what clients need including integration. It’s early days but it will definitely be interesting to see how they get on and it’s interesting that we don’t yet have a similar organisation in the UK.

Buy or Build?

The consolidation or platformisation in the industry comes from a place of wanting everything taken care of for you under one roof by someone else but there are some really interesting shifts around the approach to ‘buy or build’ right now.

One school of thought is that law firms are not software houses and shouldn’t be focusing at all on technology – it should be there and easy to use, with single sign on and none of the all too familiar challenges around integration.

In May this year I wrote an article about Access Group after speaking to CEO Doug Sawers, who is very much of the opinion that the legal sector is behind the curve in hiring tech developers. Doug’s background is in HR, where it was quite common for businesses to have lots of different HR systems and it was someone’s job to bring them together but that’s no longer the case.

Doug told me: “It takes me back 20 years. Legal practices that are having to be specialist in IT, why would they be leading edge? Why should lawyers have to invest so much in the future of technology?”

However, there is an opposing train of thought.

Going again back to Osborne Clarke and my conversation with Nathan, OC is entering what it calls a new chapter for technology by building a sizeable software engineering team, saying that the pure ‘buy’ approach to technology is no longer sufficient to achieve and retain a competitive advantage.

OC in April hired Anthony Kay as head of software engineering and Anthony is tasked with building a team of five to six people in year one, with the intention to build the team further. The roles will include full stack developers and UX designers and Nathan told me: “The rate of change means that a buy strategy alone no longer meets our requirements, as technology becomes a more important and pervasive part of what law firms deliver.”

The thought is that if you are leveraging your own technology, you can deliver real competitive advantage and I would be fascinated to come back to you on that at the end to see which side of the fence you sit on.

Tech Captives

Law firms are in many cases finding that tech-led services and products are more easily delivered from within a separate entity or captive where, being frank, it is protected from partners and the billable hour.

There is a strong shift towards productization where firms such as Allen & Overy has long led the way and done so from its tech arm aosphere but many firms are increasingly seeing commercial and repeatable opportunities.

For me an outright leader is Reed Smith’s subsidiary Gravity Stack, which in 2020 launched a natural language processing-based contract review solution and a very cool Relativity Translator app.

But firms are still trying to find the right balance to make sure that the tech arm benefits from all the expertise you have. Clifford Chance this year backtracked slightly on the plans for its tech arm Applied Solutions, which was set up as its R&D and sales arm. What they did this year was brought R&D back into the firm within a centralised hub run by April Brousseau.

Applied Solutions will remain as its sales arm. It sounds on the face of like not much of a change but what Clifford Chance found is that R&D can’t be isolated, it has to be part of the lifeblood of the firms and the lawyers have to invest in it.

Funding And Investment In Legal Tech

I said I’d talk a bit about private equity funding and it’s something that we have been tracking quite closely. We get exclusive data from a company called legalcomplex.com and the last lot of data showed that legal and tax technology companies have so far this year raised almost as much capital on the private equity markets as they did in the previous two years combined.

As of August 11 2021, $4.16bn was raised across 178 deals, compared with a total of $4.29bn raised in 2019 and 2020.

Hg are a driving force and as I mentioned before are behind the massive spate of acquisitions at Litera and also Access Group.

I’ve already talked about Hg but what you may not know is that Hg also recently invested $1bn in Insight Software, which is a leader in tax software.

In the last few months we have seen some huge legal tech funding rounds including Clio’s $250m Series D, and RocketLawyer’s $223m Series E.

And I’d like to flag as we here that several legal technology companies including Intapp, Disco and LegalZoom have floated over the past year, which shows a new stage of growth for legal tech companies.

What’s not hot is Nuix’ float in Australia, which has been a disaster. In the Australian Financial Review called it Australia’s most disastrous ever float after serious issues with its accounts emerged and I can send you more on that if you’re interested.

What Else Is Hot?

Document Management – The Magic Circle Chooses iManage

iManage now has all of the Magic Circle firms after Clifford Chance and Linklaters both selected iManage.

Linklaters at one point looked as though it would select NetDocuments, because it was very clear that the system it would choose next would be cloud-based. However, it’s a testament to the investment that iManage has made that Linklaters was impressed by the iManage Cloud and also the search and analytics capability offered by RAVN.

The Transition Back to Work – Digitisation Not Sticking Plasters

There is no doubt now in any of our minds that the future of work is hybrid and humpty dumpty is never going to be put back together in the same way, which isn’t a bad thing because Humpty was really out of shape.

But what does that really mean? It means that we need to focus on the areas where we have made do or slightly fudged solutions, and that means not relying on sending an awful lot of stuff to legal professionals by courier in absence of a truly digitised solution.

I was quite surprised when I chaired a webinar with nQ Zebraworks during the summer and we did a poll of the people attending to find out how they handle physical post and many of them courier it out to people’s homes or scan and email, meaning it can get buried in the inbox. A lot of firms still get attorneys to pick their mail up. In the short term firms are going to need to look to a fully digitised workflow.

The other things that people are doing is working out how to handle hybrid in the office.

Speaking to Matt at Linklaters the other day, they are hiring an AV team to help with the transition to hybrid in person/virtual meetings. There are so many ramifications of people being left out if they are at home, including the impact on training and development.

Capacity Management

Another thing I’ve seen quite an uptick in is a focus on capacity management. BigHand did a survey on task allocation and capacity management and it’s a huge priority. They acquired resource management experts Mason & Cook in November last year, which are one of the few vendors who can cater for it.

However, there is a new kid on the block and I like the founder a lot. I’d encourage you to take a look at Capacity Work Allocation Tool, which was launched in November last year by Dentons associate William Dougherty. What’s interesting is that not only does it help manage workloads remotely but it can help remove unconscious bias.

Transaction Management

People are working out quite late in the day that transaction management is best done in an automated platform rather than with spreadsheets everywhere.

Last year iManage acquired transaction management platform Closing Folders, NetDocuments has Closing Rooms, while Litera acquired both Transact and Doxly, and there have been many developments in the space since. ALSP Factor in June this year launched a transaction management platform.

Legatics, which is another leading transaction management platform secured £3m of investment in June this year. They also recently won firms such as Hogan Lovells and Bowmans in South Africa as clients and they are doing well.

Document Automation And Contract Management

There have been a couple of notable projects that have recently gone live in the automation space that I think are really interesting and show progress in the space.

The Loan Market Association this summer launched LMA.Automate in partnership with Avvoka and Allen & Overy. It helps LMA member to generate documents through the platform.

And Linklaters’ tech group Nakhoda this year launched a contract automation platform, CreateiQ, which allows data to be extracted at the point of creation. It is proprietary tech, developed by the Nakhoda team.

Working with ISDA they have launched ISDA Create, which enables ISDA members to draft and execute contracts through the platform. It can be used to complete really complex agreements like the ISDA master agreement.

We’re told that nearly 30 companies in the Fortune 500 and 8/10 fo the world’s largest banks now use the platform. It represents a lot of of work between the team and lawyers to categorise and tag content and break it down.

Another company that has been killing it over the past year is no code workflow automation company BRYTER, which in April raised $66m in funding. In May they signed an enterprise agreement with Reed Smith. They were working with a client that wanted to automate its process for dealing with a new supplier from a GDPR perspective, to avoid using the legal team where possible.

Updated: Reed Smith formally announces partnership with BRYTER

For in-house teams there’s been a huge focus on contract lifecycle management and what’s interesting from your perspective is that providers such as ContractPodAi are offering law firms the opportunity to become resellers. Pinsent Masons are doing it in the UK as are Rajah and Tann in Singapore. To me initially it seemed slightly uncomfortable but if you are happy that the tech is the best for your clients it is a growing way to generate new income.

Knowledge Management And Legal Research

KM has become the cool kid on the block and there is an opportunity to redefine what the role of KM is within the firm. It’s at the heart of delivering digital transformation and providing information where the fee-earner is working.

iManage, NetDocuments and newer companies like Intelllex have been working with firms to create a layer of analytics into how the knowledge management system is being used, and in enterprise search the emphasis is on using knowledge graphs to provide curated search not just federated search – much like Google it doesn’t just chuck everything ever written at you but drives more intelligent search results.

And companies like LexSoft have been working with firms behind the scene on tagging their content in order to make it more easily discoverable by the likes of RAVN’s search engine.

Leading Swiss law firm Walder Wyss has rolled out iManage Knowledge Unlocked, meaning it now has a better understanding of how members of the firm are using its knowledge management system, what searches they are carrying out, and where the gaps are in their library.

Speaking to Legal IT Insider, legal engineer and head of KM Urs Bracher said: “What’s new to us is the analytics module and we can see how the user numbers are; who are the most active users; what content is looked for most often; and even what content is missing, where searches do not lead to results.”

What’s Not Hot?

A Million Different Point Solutions.

Blockchain, which has reached the trough of disillusion in Gartner’s latest hype cycle.

The speed of migration off sunsetted practice management systems is also ‘not hot’, with many firms still on Thomson Reuters Elite Envision or Enterprise. Check out our new US top 200 for more.

Please email me your ‘what’s hot’ and let’s start a discussion. One thing I haven’t included is the hugely interesting work being done in the research space, which is a topic in itself and one I may come back to.

Caroline.hill@legalitlexicon.com